- Version

- Download 12

- File Size 276 KB

- File Count 1

- Create Date 04/11/2024

- Last Updated 04/11/2024

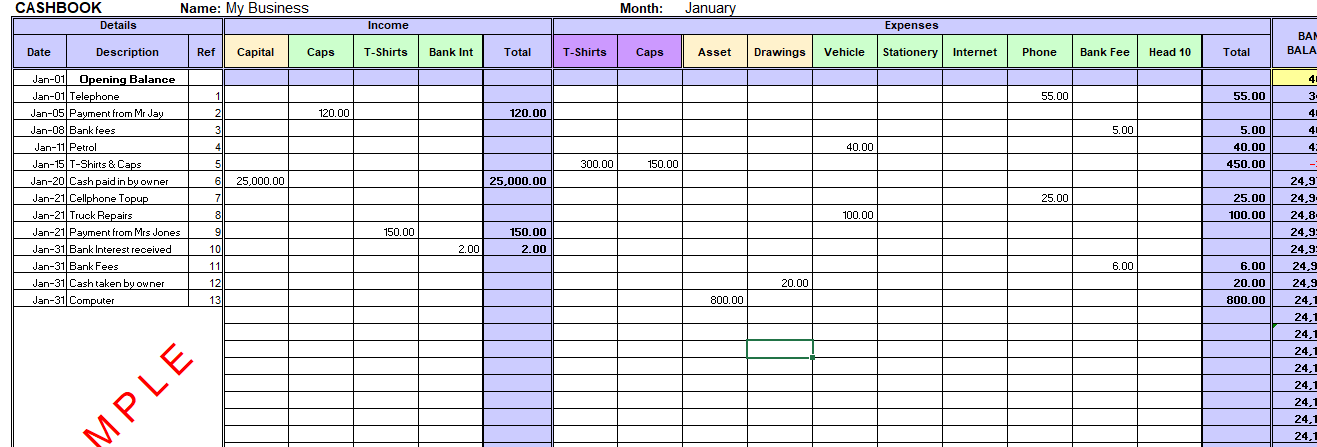

Cash book With Income Statement Template

HOW TO USE THE CASHBOOK EXCEL TEMPLATE

A cashbook Excel template is designed to help businesses systematically record all cash transactions. It includes sections for income, COGS, expenses, and an annual income statement. By using this template, you can easily track your financial activities and generate essential reports.

Step-by-Step Instructions

- Open the Template

- Download the cashbook Excel template.

- Open the file in Microsoft Excel or any compatible spreadsheet software.

- Enter Your Business Name

- Navigate to the Control Sheet at the top of the template.

- In the designated cell, enter your business name. This will personalize your cashbook and make it easy to identify.

- Set Up Headings for Income, COGS, and Expenses

- In the Control Sheet, you will find predefined headings for each section:

- Income Section: Heading 1,2, 3... which you can customise to different Categories such as Sales Revenue, Service Income, and Other Income.

- Cost of Goods Sold: Direct costs associated with products sold.

- Expenses Section: Categories like Rent, Utilities, Salaries, Marketing, etc.

- Feel free to customize these headings based on your specific business needs by editing the cells directly.

- Recording Transactions

Income Section

- Navigate to the Income Section of the template.

- For each transaction:

- Enter the date of the transaction in the "Date" column.

- Describe the source of income in the "Description" column (e.g., "Product Sale").

- Input the amount received in the "Amount" column.

Cost of Goods Sold (COGS)

- Move to the COGS Section.

- Record each COGS transaction similarly:

- Enter the date.

- Describe the item or service related to COGS (e.g., "Raw Materials").

- Input the cost in the amount column.

Expenses Section

- Go to the Expenses Section.

- For each expense:

- Enter the date of the expense.

- Provide a description (e.g., "Office Rent").

- Input the amount spent.

- Reviewing Totals and Balances

- The template should automatically calculate totals for each section (Income, COGS, and Expenses) using built-in formulas.

- Check these totals regularly to ensure accuracy in your records.

- Generating the Annual Income Statement

- At year-end or at any reporting period, navigate to the Annual Income Statement section of your template.

- The statement will automatically summarize:

- Total Income

- Total COGS

- Gross Profit (calculated as Total Income minus Total COGS)

- Total Expenses

- Net Income (calculated as Gross Profit minus Total Expenses)

- Analysing Financial Performance

- Use the annual income statement to assess your business's financial performance over time.

- Look for trends in income and expenses to inform future budgeting and forecasting decisions.

Tips for Effective Use

- Regular Updates: Update your cashbook regularly (daily or weekly) to maintain accurate records.

- Backup Your Data: Regularly save and back up your Excel file to prevent data loss.

- Customize Further: Feel free to add additional sheets or categories as needed based on your business operations.

Using a cashbook Excel template is an effective way to manage your business finances. By systematically recording income, COGS, and expenses, you can maintain accurate financial records and generate insightful reports that aid in decision-making.

If you haven't already done so, download your free cashbook Excel template today! Start tracking your financial transactions with ease and gain better control over your business finances!